HARD BREXIT – THE IMPACT ON FINANCIAL SERVICES FIRMS

EXECUTIVE SUMMARY

Disrupting the ability to service existing clients in the EU due to the loss of passporting rights and in the absence of a transition period under a withdrawal agreement to adjust their service models.

Post Hard Brexit UK entities will not be permitted to provide services to, or trade with, existing or new EEA located clients unless the particular jurisdiction has in-acted the necessary transitional arrangements.

MiFID II has provided a more unified approach to Reverse Solicitation throughout the EU making it more difficult to operate such a business model. At a minimum the requirement of retention of records and no marketing of new categories of investment products.

Chaperoning would require local regulatory practices be met. Services provided from the UK would have to be intermediated through EU based personnel.

With Boris Johnson one of the leading voices of the Leave campaign now as Prime Minister of the UK and his appointment of a cabinet full of Brexiters actively voicing their collective determination to leave the EU on the 31st October, 2019 we are now far closer to a hard Brexit scenario than at any time since the referendum result of 23rd June, 2016.

It would seem that the message from 10 Downing Street to Brussels is clear that the previously negotiated Withdrawal Agreement by Teresa May with the inclusion of the Northern Irish Backstop is no longer acceptable.

Although other than sound bites regarding good faith negotiations there are little or no alternative proposals being put forward by the new UK government to the EU.

Whilst hard Brexit planning has ramped up since Boris Johnson entered 10 Downing Street, the reality laid bare by the leaking of the secret dossier “Yellowhammer” in The Sunday Times, is that the UK is hopelessly underprepared for the 31st October 2019 exit date.

SO, WHAT DOES THIS ALL MEAN FOR THE UK FINANCIAL SERVICES INDUSTRY?

Many UK based financial services firms have already activated Brexit plans and set up legal entities in the EU in anticipation of the UK leaving whether under a withdrawal agreement or a Hard Brexit. Whilst others have taken a more strategic view, to await events and then adjust platforms accordingly.

For the latter category, a hard Brexit scenario could be a cliff-edge event. Disrupting the ability to service existing clients in the EU due to the loss of passporting rights and in the absence of a transition period under a withdrawal agreement to adjust their service models.

IS THERE ANY MITIGATION AVAILABLE?

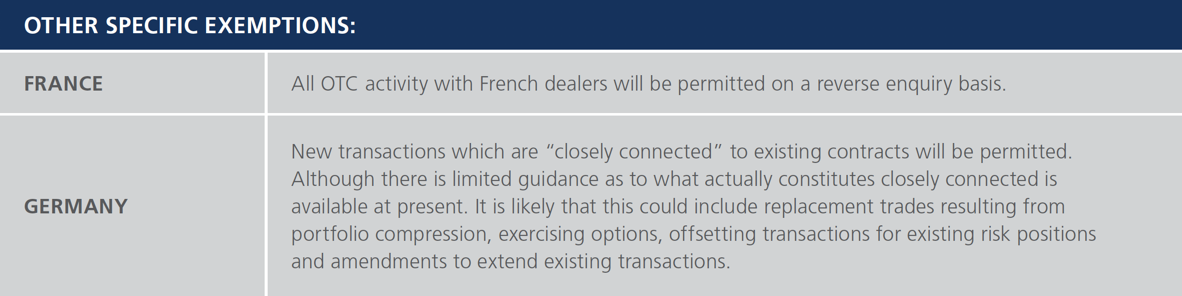

Certain EU jurisdictions have legislated for a hard Brexit, introducing bilateral exemptions or transitional arrangements which allow for UK entities to continue to service professional clients and Eligible counterparties for a limited transitional period.

Post Hard Brexit UK incorporated entities will not be permitted to provide services to, or trade with, existing or new EEA located clients unless the particular jurisdiction has in-acted the necessary transitional arrangements.

Below a summary of a limited number of jurisdictions that have either existing or new transitional arrangements:

COULD REVERSE SOLICITATION BE AN ANSWER?

The introduction of Mifid 2 in January 2018 has provided a more unified approach to reverse solicitation throughout the EU making it more difficult by raising the collective standard.

With the consequence that cross-border practices have subsequently been under greater scrutiny by EU 27 regulators.

Reverse solicitation comes with heightened risk as it is now a question of fact and circumstance and not merely a legal decision.

ESMA Q&A on this topic has suggested that at a minimum requirement of retention of records and no marketing of new categories of investment products should be observed.

WHAT ABOUT CHAPERONING BY AN EU BASED AND REGULATED FIRM?

Chaperoning in itself is not a silver bullet as local regulatory practices would have to be met. Services provided from the UK would have to be intermediated through EU based personnel.

Author:

Ifther Ali

Partner, Palladris Consulting Legal, Compliance & Governance

Find out more about what we do